CBL Corporation Ltd (ASX:CBL) released a disappointing market update this morning, one of the worst I have seen in a while. Ultimately, I think the update calls into question the company's expertise, making it a concerning read for all shareholders.

CBL announced that it needs to strengthen its future claims reserve by $100 million and would write off $44 million in receivables following the acquisition of SFS in 2017. As a result, CBL Group expects to report a loss of $75 million to $85 million for financial year 2017.

Of these $100 million in reserve strengthening, $10 million relates to financial year 2017, and $90 million relates to prior years. This indicates that CBL has been under-reserving against its claims and management stated today that "the data exercise backs up the overall profitability of the French construction business, but at lower levels than recommended or reported in the past."

This apparently means that the French construction insurance business is not as good as CBL has historically claimed. Worse, the $100 million in provisions may be a threat to CBL's minimum required solvency capital, as CBL only had $54 million in excess solvency capital as of 30 June 2017.

If I understand correctly, the $100 million increase in provisions would mean that, if not mitigated, CBL would be below minimum required solvency levels and would have to raise capital immediately. I assume that is why CBL also declared today that it would launch a capital raising, with further information to be provided on that soon.

So what?

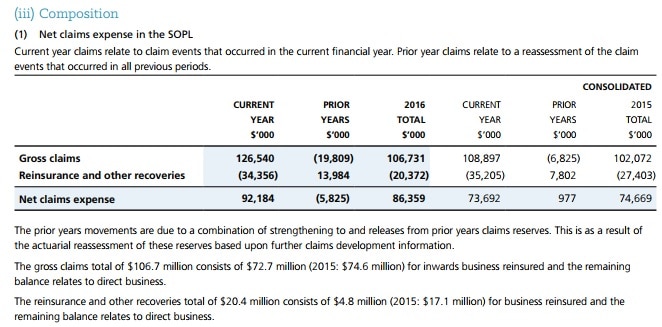

One concern I have is that it looks like CBL has done some strange things with its provisions. This is something that was pointed out to me a few months ago by another investor and former shareholder, Scott Milson. In its 2016 annual results, CBL released $5 million in provisions which I assume contributed to it beating its prospectus forecasts numbers. 2016 was the first year it's released reserves since 2011.

I am not suggesting there is anything suspicious about this per se – indeed I looked at these charts when I first purchased shares and didn't think much of it. However, in light of what has been announced in the 12 months since then, it leads to questions about the quality of CBL's reserve processes, in my opinion.

Also, following this, company insiders sold $60 million worth of shares (8.5% of the company) in April 2017, two months after the annual report. Three months later, in July 2017, "Questions arose around Elite's reserving on its French construction business." One month after that, CBL announced that it had to strengthen its prior clear claim reserves by $16.5 million – just 6 months after reducing them. Now CBL has to book another $100 million in reserves.

Clearly, senior management sold their shares at exactly the right time. Again, on its own that is not a concern – they still have significant stakes and are very long-term owners of the business. Founders commonly look to sell down in or after the IPO process. However, in combination with the reserve releases and subsequent increased provisioning, the timing leaves a bad taste in my mouth.

The bigger concern to my mind is the shadow that's been cast over the company's actuarial processes. Here we have a specialty insurer that often talks about how profitable it is, that has just discovered that actually it's not as profitable as it thought it was. More so, it has to make adjustments for the last 10 years of policies and the adjustments are so large that it may affect the company's minimum solvency levels. This is not a good look for a business that is supposed to be a prudent insurer of long-term policies.

It also raises the question of whether the company is really reserving appropriately against risks in its other policies. For example, CBL management announced today that revenue growth would be 35%, compared to prior guidance of 12% to 15%, due to growth in overseas markets including Spain, Italy, and Mexico. I've been cautiously optimistic on CBL's international expansion in the past. However, now that revenues are suddenly growing at 3x the rate of previous forecasts, and now that CBL's reserves have been shown to be inadequate, I am sceptical of whether CBL is pricing risk appropriately.

There is a Warren Buffett quote on insurance (from the book Confidence Game) that springs to mind: "If you're willing to do dumb things in insurance, the world will find you. You can be in a rowboat in the middle of the Atlantic; just whisper 'I'm willing to write this,' and then name a dumb price. You will have brokers swimming to you – with their fins showing, incidentally."

I'm not saying CBL is doing dumb things – previously I've held quite a high opinion of the company and thought management was capable. However, with the update today I think it is also necessary for shareholders to consider the opposite side of the coin. What if CBL is not as smart an insurer as it thinks it is?

I have no answers to that just yet. I continue to hold my shares, but I am actively considering whether I've been wrong enough on the company to make it a 'sell'. I will write about it if I decide to sell.