The spike in bond yields following reports that China is contemplating cutting back on its purchase of US government debt has only reinforced predictions of the end of an era for bond bulls.

Local share investors have been curiously observing what could be the end of a 36-year bull market for credit with morbid curiosity – much like how one would slow down to see a car crash on a highway.

But don't be fooled into thinking this won't affect us equity investors. There are at least two significant ways the bond market will impact on our share portfolio.

The first and more obvious impact is a rise in borrowing costs. When the price of a debt security drops, its interest rate rises as price and rates are inversely correlated.

A bond bear market means prices will drop and rates will rise, making it more expensive for companies and consumers to borrow. This will impinge on company profits.

But even companies with no debt will be negatively affected. A higher government bond rate will depress stock valuations as the discount rate that analysts use in calculating price targets are benchmarked to this.

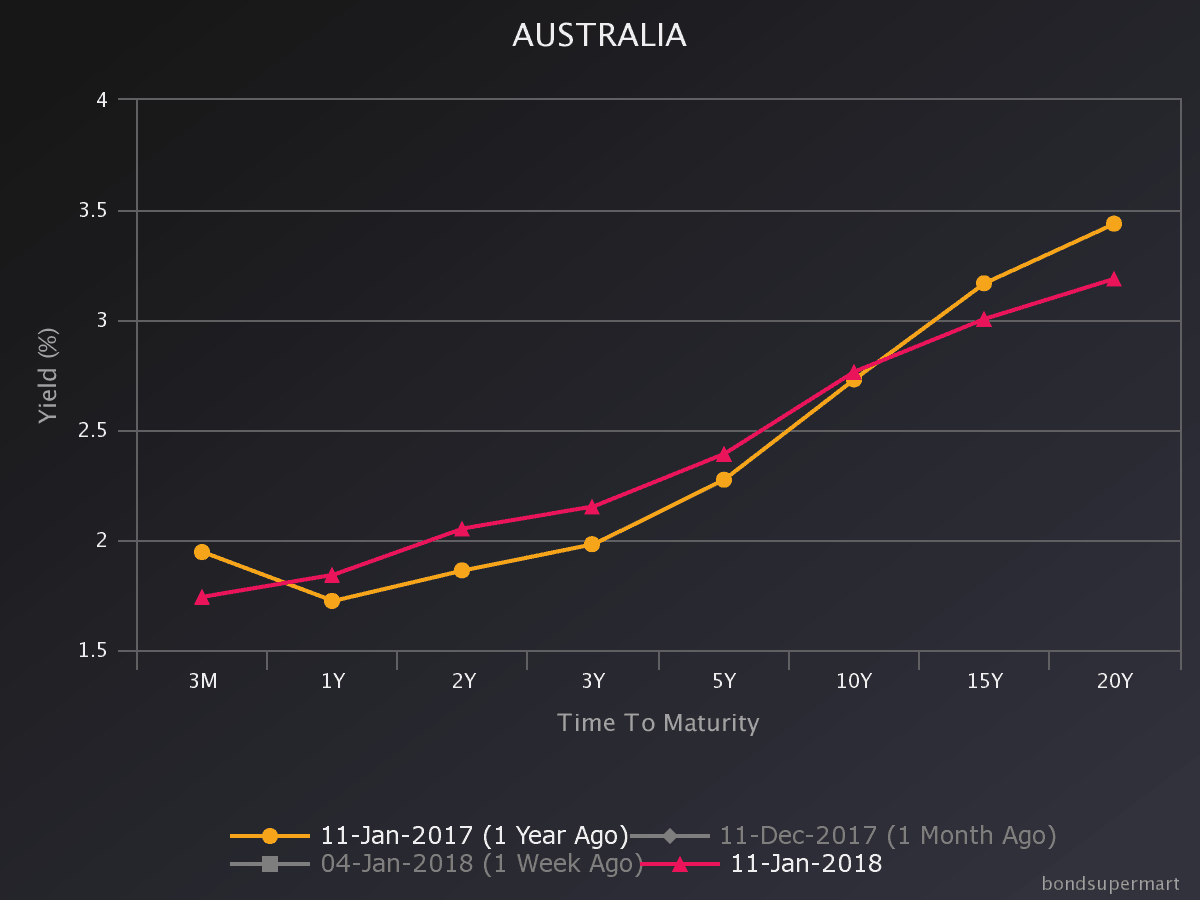

The other issue is the flattening of the yield curve. This is when interest rates on short-term debt (such as government bonds that mature in two years) rise faster than long-term debt (such as government bonds that mature in ten years).

Expectations that the US Federal Reserve will raise the Fed Funds Rate are probably the key driver for the flattening yield curve. Short-dated bonds are more sensitive to the interest rate changes by the central bank.

The Australian market often takes its cue from the US market and there is a distinct flattening of the yield curve here.

There are several implications for stocks. Research by Citigroup shows value stocks are positively correlated to a steepening yield curve while growth stocks are negatively correlated to this trend.

What this means is that a flattening yield curve could give growth stocks more runway to outperform as they have been in 2017. If you looked at the list of the best performing large cap stocks, it is dominated by companies with strong earnings growth momentum and high price-earnings (P/E) multiples.

These top performers include gaming machine maker Aristocrat Leisure Limited (ASX: ALL), wine maker Treasury Wine Estates Ltd (ASX: TWE), construction group Cimic Group Ltd (ASX: CIM), blood products company CSL Limited (ASX: CSL) and online property classifieds group REA Group Limited (ASX: REA).

It may be too early to switch out of growth for value stocks for 2018, so bargain hunters will need to be particularly careful when trawling for cheap shares.

Our Big Banks will also have a harder time outperforming when the yield curve flattens as they typically borrow long to lend short.

It will probably be challenging for the likes of Commonwealth Bank of Australia (ASX: CBA), Westpac Banking Corp (ASX: WBC), Australia and New Zealand Banking Group (ASX: ANZ) and National Australia Bank Ltd. (ASX: NAB) to expand their margins in such an environment.

The good news is that the yield curve will have little impact on a sector that the experts at the Motley Fool are particularly bullish on.

Like to find out what this sector is and the stocks to watch for 2018? Click on the link below to get your free report.