Back in September, I sold all of my Retail Food Group Limited (ASX: RFG) shares at around $5.50.

Although this looks like a good decision in hindsight, I wanted to revisit the rationale behind my selling to determine if it was a good decision per se – and would it still have been a good decision if not for the recent collapse in the company's share price?

First, it's necessary to revisit why I bought. I was previously bullish on the company and thought, that it had good brands that it was under-investing in, as well as significant opportunities to expand.

RFG announced a while ago that it would be investing in new products and marketing for its brands like Donut King and Michel's, and I thought that sales would be likely to improve, as these franchises sell basically the same products they did 20 years ago. The last major upgrade to Donut King, as far as I know, involved adding coffee machines and that was a long time ago.

Additionally, Retail Food is one of Australia's largest coffee roasters, which I figured would give it a scale advantage in a growing market, and the company was expanding rapidly overseas. The joint venture in China with its Gloria Jeans franchise also had promise. I thought there were a number of things all coming together that would improve business earnings. And then I came across some rumblings:

There were a few reasons to be concerned about Retail Food Group. Sure, there's reasons to be negative about every company, and the best investors make money by holding growing businesses over the long term despite being faced with a 'wall of worries'. I became aware that the company was heavily short sold, the short-selling thesis was fairly well put together, and that there were franchisee problems at 7-Eleven and Domino's Pizza Enterprises Ltd. (ASX: DMP), as well as accusations of the same at RFG.

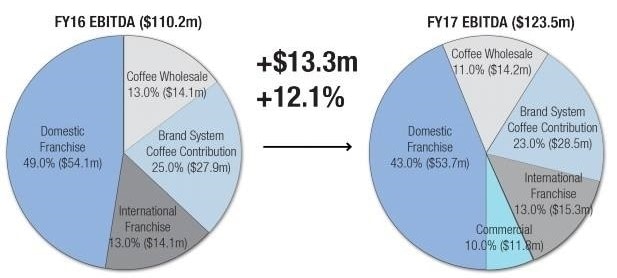

Yet I couldn't determine whether this was just noise or whether there was something to it, and so I waited until the full-year results in August. At that time, this chart spooked me:

As did the following sentence from page 7 of the annual report:

"New outlet commissionings for FY17 were 210 (PCP:258) and net outlet decline of 14 was realised in FY17 (PCP: growth of 84)."

I thought if the company was truly expanding overseas and its franchises are a great opportunity, outlet count and 'Domestic Franchise EBITDA' (pie chart above) should be increasing. While an outlet decline of 14 stores doesn't sound that bad (Retail Food has 2,516 outlets) the degree of reversal from the prior year ('PCP', above) made me concerned. Net outlet decline of 14 stores, after accounting for 210 new outlet commissions, also suggests that 224 stores, or 9% of the network, closed down or changed hands. I wondered how sustainable the business model was if 9% of franchisees were quitting their stores every year.

I didn't spot this at the time, but I re-read the company's FY17 commentary this morning for this article, and it was a bit convoluted with the way it was described, in my opinion:

"RFG also registered 210 new store commissionings, bringing the total number of Brand System outlets at the close of FY17 to 2,516."

This clearly implies there were 210 new stores opened, even though actually the company experienced a 'net outlet decline of 14'.

Whatever, considering all the talk about growth at RFG, the company's store count simply should not have been going backwards, and this was the catalyst that made me wonder if the short thesis and alleged problems with franchisee stores were accurate. I sold my shares a week or two later.

Was it a good decision?

There wasn't a lot of analysis that went into the sale decision. As far as I was concerned, the outlet decline was something that wasn't explained by the company's announcements, which made me wonder if alternative explanations (e.g. franchisees under pressure) were valid. I saw smoke, wondered if there might be fire attached, and didn't wait around to find out. I could easily have looked foolish (lower case 'F') if the concerns were overblown. However, I wasn't making a bet on a negative future for Retail Food Group, I simply did not know what was going on, and the uncertainty was too high for me to remain comfortable holding.

I think that from a 'peace of mind' and 'preserving capital' perspective, selling was the correct decision. While the cost (in lost profits and brokerage) of selling shares and moving to cash can be very high, the risk of holding cash is very low. The outcome – RFG shares subsequently collapsing – is only incidental in this case. I would probably make the same decision again in the future.

However, I also need to be aware that if I take this approach, at some point in the future I will sell a promising company because of 'smoke' and potentially miss out on making a lot of money. So while this specific decision was sound, from a whole-of-portfolio perspective, it may actually be better to risk taking some hits in order to maximise the chances of holding winners for the long term.

Owning shares is a risky and uncertain business, and at some point every investor will make a losing investment. Fortunately, I dodged this one.