- Fund size: $1Bn

- Asset allocation: 99% Australian equities, 1% cash

- Investment style: Blend of large cap stocks

- Fees: Management fee of 0.923% per annum and performance fees of 15% of outperformance of returns above the benchmark

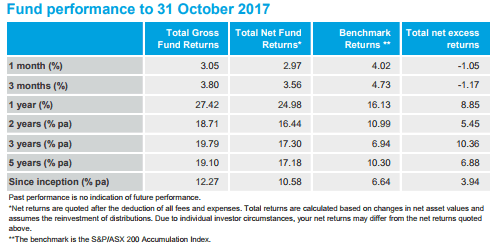

- Fund performance: The fund's performance is outlined below. The fund has outperformed its benchmark since inception in 2005 with an annual gross return of 12.27% over the same period.

The key contributors to the fund's performance recently were:

- BlueScope Steel Limited (ASX: BSL). Its share price is up 50% over the last year despite a slump in August after the announcement of the imminent departure of CEO Paul O'Malley, a softer outlook for FY18, and allegations of price fixing prompting an investigation by the competition watchdog the ACCC. BlueScope reported a net profit after tax of $715.9 million for FY17, up more than 100% on the previous year.

Other overweight positions in this fund include Boral Limited (ASX: BLD), Reliance Worldwide Corporation Aus P Ltd (ASX: RWC) and Woodside Petroleum Limited (ASX: WPL).

Foolish takeaway

Overall, whilst the fund's performance has been really good since inception, past performance is not an indication of future performance. If a fund is not what you are after and you would like to go for it alone, you might want to have a look at these three Aussie companies that are taking over the world.