There was a big splash when XERO FPO NZX (ASX:XRO) reported its first half results last week.

The two big talking points were Xero's plan to de-list from the New Zealand exchange, the NZX, and the company's first ever positive earnings (before interest, tax, depreciation and amortisation).

But from the coverage I've seen so far I think there are still some misconceptions about the way people view the business.

1. Xero is a platform, not a static piece of software

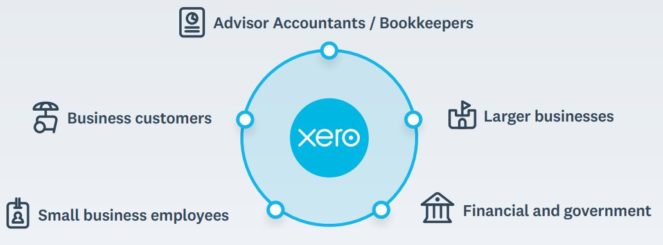

I think a lot of people still view Xero's product as a static piece of cloud software when it has evolved far beyond that today.

Xero has built a platform from which accountants and small businesses can link to their key stakeholders, like banks and suppliers. It also gives them access to additional add-on services they need which can add incredible value.

This is important to understand because it can change the way we think about valuing Xero shares.

For example comparing Xero's price-to-sales ratio to that of Myob Group Ltd (ASX: MYO) or Reckon Limited (ASX: RKN) doesn't have much validity in my view. The products offered by the respective companies, and the future earning potential of those products, are too wildly different.

If we are going to do a relative comparison to another company we need to either ensure we are comparing similar platform businesses, or clearly adjust for the differences in growth potential.

2. Xero has enormous pricing power

When you start to think of Xero as a platform it gets easier to see how the company can command a price premium over competing services. By integrating deeply into into the companies it serves switching and re-training employees to a new system becomes a daunting prospect.

This level of integration and reliance also helps to insulate Xero from changes in economic conditions where consumer discretionary subscription services like Spotify or Netflix may be more vulnerable.

3. Xero still has all the hallmarks of a great 'Rule breaker' company

When I hear people branding Xero shares as 'overpriced' I can't help but think of Motley Fool co-founder David Gardner's 'Rule Breaker' investing principles.

These are companies which have strong prospects, but don't measure up with traditional value investing 'rules'. I've sized Xero up against Gardner's principles in the past and you can read about it here.

I think Xero still meets all the hallmarks of a great 'Rule breaker' company, including holding a sustainable advantage, strong past price appreciation and great management.

It just takes looking beyond the key talking points to understand why.