I'm always interested in finding businesses that I can invest in and hold for a very long time.

InvoCare Limited (ASX: IVC) could be one of the best buy-and-hold shares for the following reasons:

Defensive earnings

InvoCare is the largest provider of funeral services in Australia with a market share of around a third.

A funeral is a morbid service to provide but it has very routine revenue. Sadly, a certain amount of us pass away each year and families want to send their relative on with a respectful funeral.

A funeral is one of the first things that a family does, usually out of the assets of the deceased. Or they may use a prepaid funeral or funeral insurance that has already been arranged.

Multi-brand strategy

InvoCare has acquired a number of different businesses over the years. The result is that it has multiple brands to appeal to different price points and different regions.

The business does own three national brands, being White Lady Funerals, Simplicity Funerals and Value Cremations.

I think this is a clever strategy that will keep on generating a lot of revenue and maintain market share.

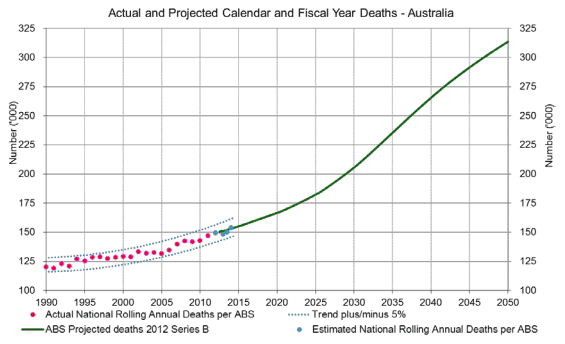

Predicted growth of the industry

The Australian population is steadily ageing and this is resulting in a growing 'death rate', according to the Australian Bureau of Statistics.

The death rate is expected to grow at an increasingly faster rate until the early 2030s, which means InvoCare could be in for a lot of growth between now and then.

This graph is a very good illustration of the predicted number of deaths over the coming decades:

Foolish takeaway

The historical growth and potential growth of InvoCare hasn't gone unnoticed. Its shares are currently trading at 31x FY18's estimated earnings with a grossed-up dividend yield of 3.67%. This is about as expensive in price/earnings ratio terms as it has ever been, so I would be wary of buying at today's price.