The XERO FPO NZX (ASX: XRO) share price is down 6% to $29 this morning, after the company released its first-half results to the market. Here's what you need to know (all figures in $NZ):

- Subscription revenue rose 38% to $183 million

- Net loss after tax narrowed to $21m ($44m loss previously)

- First ever positive earnings before interest, tax, depreciation and amortisation (EBITDA) of $5.4 million

- First ever positive operating cash flow of $6.1 million

- Annualised committed monthly revenue rose 38% to $417 million*

- Margins continue to widen as Xero grows subscribers faster than costs

- Xero established a $100m debt facility, with no current plans to draw on it

- Outlook for managing the business to reach break-even within the current cash balance, without relying on debt facilities

So what?

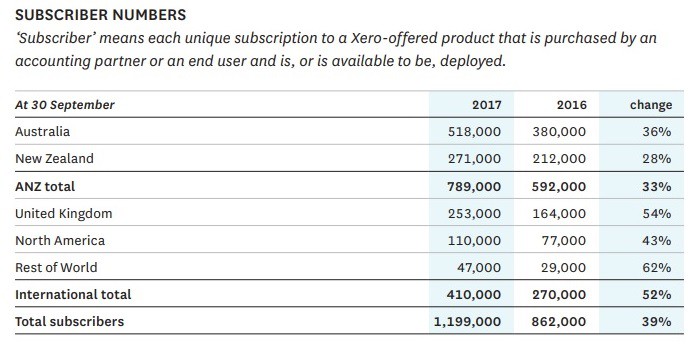

Xero continued to report strong growth in the quarter, although its acquisition of new customers in the USA has slowed dramatically:

Management didn't really explain the slower US growth in depth, attributing it to 'slower market adoption of cloud accounting'.

At a guess I'd say that's why shares fell today, although Xero also looks expensive on every conventional metric.

Xero is currently making progress towards localising its product for Singaporean and South African markets, and those regions will be the next target for the company's growth, even as it continues to expand in ANZ and the UK.

Probably the highlight for me was that Xero continues to focus on reaching break-even within its current cash balance, without having to raise capital or use debt.

Xero could become profitable overnight if it lowered its spending on R&D and marketing, but equally, the company could continue to run operating losses for many years if it continued to invest at the same pace as previously.

Once the company starts to sustainably generate cash, investors will get a better picture of what the business is able to achieve just from reinvesting its earnings, not relying on excess funding.

Now what?

While Xero looks expensive today, it's also growing at a cracking rate, and it is important to note just how much further the company may be able to grow in its existing markets.

For example, Xero has been operating in New Zealand since 2006 and is the largest cloud accounting software company in the country, and it is still growing subscribers at a rate of nearly 30% per annum.

Customer churn is falling, as Xero's apps improve and the software integrates more closely with customers, and it's also getting cheaper to acquire new customers. Despite the slow progress in the USA, I think it would be a mistake to bet against Xero today.