The Telstra Corporation Ltd (ASX: TLS) share price has bounced off a recent low, but it's not out of the woods just yet.

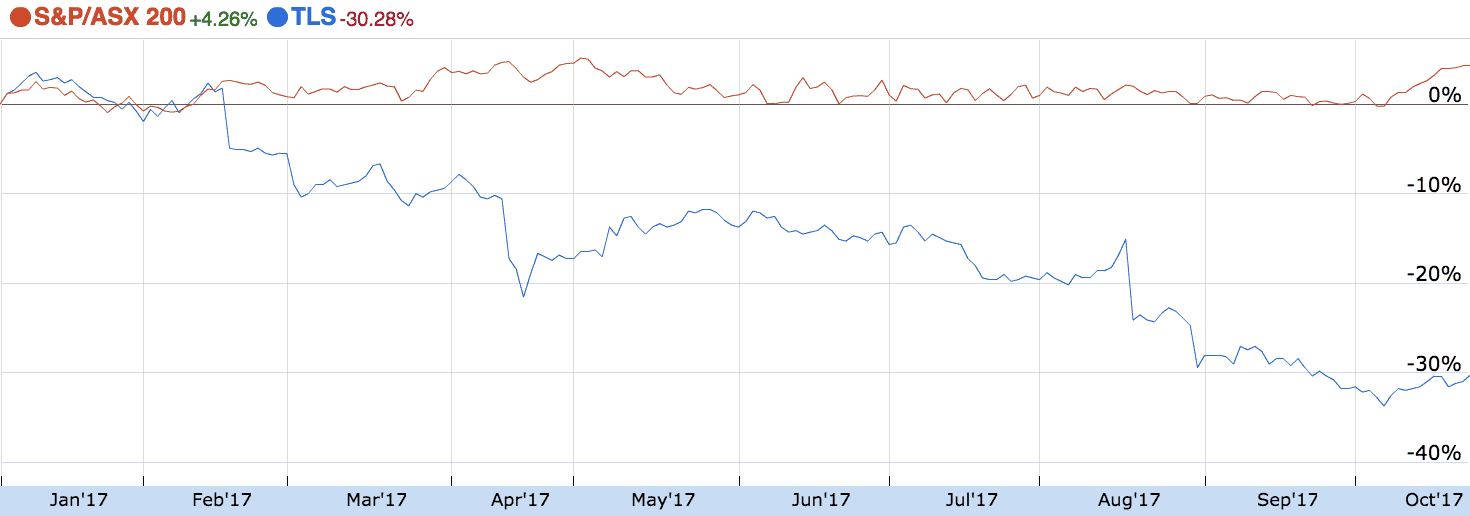

Telstra V. ASX 200

The chart above shows Telstra shares versus the market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO). As can be seen, Telstra has drastically underperformed the market in 2017 but the selloff appears to have eased recently.

Are Telstra shares good value?

At today's prices and using last year's results, Telstra shares look like great value. Shares trade at a trailing dividend yield of 8.8% — with full franking — and below market value using the price-earnings ratio.

However, since the share market is forward-looking and we invest by looking towards the future — not the past — we should focus on what investors can expect in coming years.

First of all, the dividend will be cut. Probably to 22 cents from the current 31 cents per share.

That's according to numerous analyst forecasts. Nevertheless, even at 22 cents per share, Telstra shares offer a 6% dividend yield.

Next up, valuation.

As I have said recently, Telstra shares are perhaps not a standout bargain at today's prices. With the NBN eroding Telstra's competitive advantage in broadband and home phone, and competition heating up in mobiles, it will likely come down to how well the mobiles business responds to extra competition.

Personally, I think Telstra will be less affected by new entrants to the mobiles market than its competitors given its network reliability and reach. Therefore, in terms of valuation, I think Telstra shares are decent value today but they are not a bargain.

Foolish Takeaway

At today's prices, I think Telstra is better value than many other blue chip shares on the ASX. But I'm not rushing out to buy any for my portfolio. I'm waiting for a more compelling entry point.