This week I've been thinking about cloud accounting firm XERO FPO NZX (ASX: XRO).

The company's share price has rocketed 86% in the last 12 months after being almost flat for two years in 2015 and 2016, so what's changed?

To me there are three obvious reasons Xero shares have taken off now:

1. Tech stocks are bringing sexy back

The demand for quality, growing technology stocks has rocketed this year.

This is partly a 'halo' effect from the rise in big U.S. tech companies, but I think there are local drivers too.

The shift coincides with a wave of investors dumping big dividend paying blue-chips after a string of rubbish results. I think investors no longer view these legacy dividend plays as a 'safe option'.

Last year's all-stars like Telstra Corporation Ltd (ASX: TLS), Fletcher Building Limited (Australia) (ASX:FBU) and QBE Insurance Group Ltd (ASX: QBE) are close to dead and buried.

Ironically, it has been the young tech sector which has continued to deliver on promises of growth and investors love the idea of certainty. Shares in Altium Limited (ASX: ALU) and REA Group Limited (ASX: REA) have risen 32% in the last 12 months, while the WiseTech Global Ltd (ASX: WTC) share price is up 92%.

2. Delivering on growth

Xero in particular has done a great job delivering for investors in 2017.

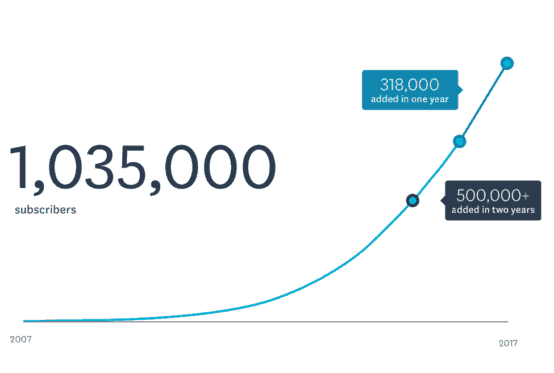

Not only did the company pass 1 million subscribers, but the company's operating revenue grew 43% and it has continued to deliver new products which add value to customers.

Xero has been demonstrating the huge value that technology companies can create through scaling – growing incremental sales at very little cost. Scaling has been called "the most powerful concept in technology" and Xero is leveraging it to full effect.

3. Nearing profitability

Xero's scaling has accelerated the company towards profitability which has been a big driver of increased investor interest. This interest includes big investment funds which have previously been cautious of owning loss making companies.

New Zealand listed fund Kingfish has reportedly allocated 3% of its NZ$270 million assets to shares in Xero. The fund said it estimates Xero's Australian and New Zealand businesses were profitable in the 2017 financial year and expects continued earnings growth.

Xero reported revenue of almost NZ$300 million to 31 March 2017 and is targeting NZ$1 billion in revenue in the coming years.

Although Xero's share price has taken a breather this week, I think it's best days are certainly ahead of it. I would be keen to add to my existing position if the price dips in the months ahead.