TPG Telecom Ltd (ASX: TPM) shares offer franking credits and potential growth, in one investment.

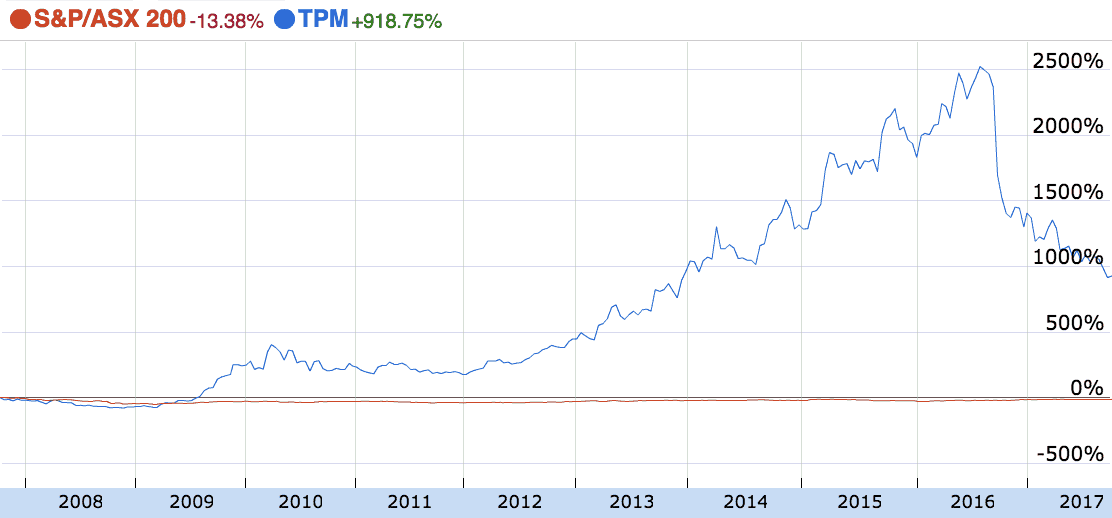

TPG Telecom V. ASX 200

TPG, Australia's third-largest telecommunications company, has underperformed the broader market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), in recent years. However, over the long run, the company's share price has hugely outperformed the market.

In addition, TPG has paid a rising stream of dividends to shareholders over the past decade.

2 reasons to have dividend shares like TPG Telecom Ltd on your watchlist

- (tax effective) Income

Despite competition concerns and fears that the NBN will damage its business, analysts expect TPG to pay a very modest dividend in the year ahead. However, that's on account of increased investment in its mobiles business in Australia and Singapore. If that investment is successful, long-term income-seeking shareholders could stand to benefit.

With full franking credits, Australian residents may also be eligible to benefit from 'tax credits' to hold TPG shares.

- Growth

If you invest in bonds (not many people do it directly), you can receive a reliable stream of income from your investment. But the level of income normally won't change from the time you buy the bond until you sell it.

Conversely, although TPG shares offer a small yield now, its dividends may grow strongly over time. It's not guaranteed, of course, but if it can return to its previous level of profitability and shareholder dividends, it might still be a great investment for income.

Foolish Takeaway

Medium-sized growing companies like TPG, Greencross Limited (ASX: GXL) and Flight Centre Travel Group Ltd (ASX: FLT) have shown that over the long run investing for dividends and growth can be very lucrative. However, while TPG shares appear tempting at today's prices, I have it firmly on my watchlist until I am offered a more compelling entry point.