Including dividends, my investment in Platinum Asset Management Limited (ASX: PTM) shares in May are now up 50%!

Not a half-bad return for a five-month investment.

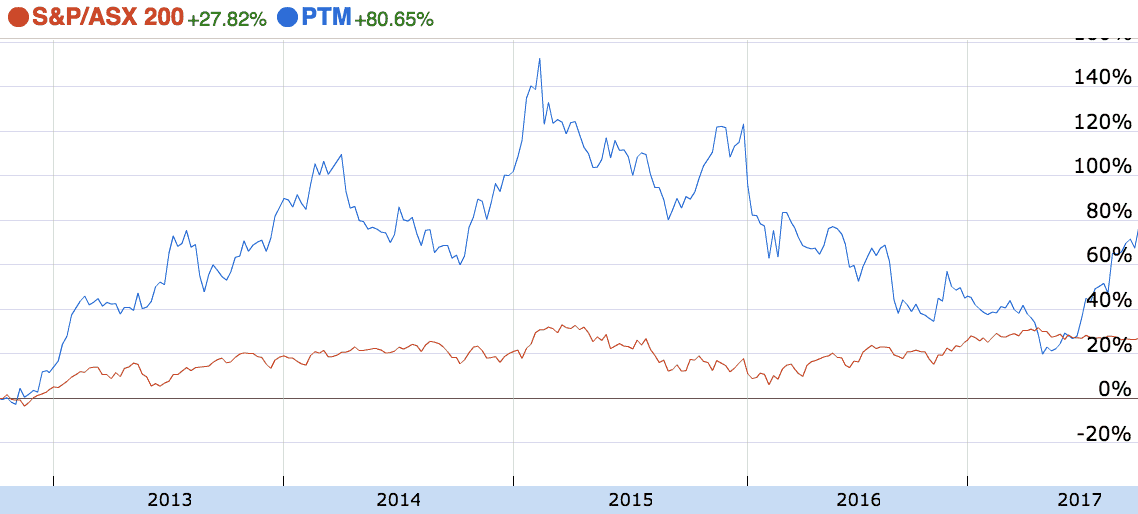

Platinum V. ASX 200

As can be seen above, it would seem Platinum shares have come back from the brink to rally in 2017. Not including dividends, the market or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) is up just 2% in 2017 while Platinum is up 24%.

What's going on?

After a few years of mediocre investment performance and money leaving the business, it seems the 23-year-old investment company may have finally turned a corner.

According to Bloomberg, Platinum's bets on Samsung, Tencent Holdings, PICC Property & Casualty and China have boosted the performance of the flagship Platinum international fund.

"A smaller, unhedged global fund soared 36 percent, according to Morningstar Inc., performing better than any other Australian money manager," Bloomberg reported.

Importantly, despite its funds under management (FUM) falling nearly 10% over the 12 months to June, its FUM is up 22% so far in 2017.

FUM is a key metric for investment companies like Platinum since they earn fees based on the amount of money under their control.

Curiously, no analysts covering the company are recommending Platinum shares as a buy. According to Bloomberg, analysts are bearish due to Platinum's decision to cut fees earlier this year.

Foolish Takeaway

Aside from a passive ETF, Platinum is the only ASX share I have bought in 2017, and I have been well rewarded for my investment.

In May I wrote: "Over the past five years, some international fund managers — such as some Sydney-based companies that are in competition with Platinum (not naming names) — have looked like geniuses because they bought American tech stocks. That's okay. But with markets being cyclical and the US markets looking a little expensive, it may be time to transition."

While that thesis was a no-brainer in my view, at today's prices, I'd agree with some analysts in suggesting that Platinum's stock is not as cheaply priced as it was earlier this year. Therefore, though I would still take Platinum shares over many other dividend shares on the ASX, I'm not in a rush to buy Platinum shares today.