I have to admit that I almost missed it at first glance, but the dividend paid by Woodside Petroleum Limited (ASX: WPL) is a fair bit healthier than the 80% payout ratio alone suggests.

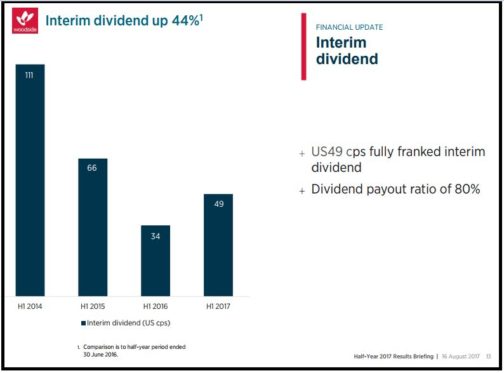

Woodside paid out $413 million in dividends in the first half of the financial year, equal to a payout ratio of 80% of net profit after tax (NPAT). This is a nice clean number and the one the company presented in its results briefing.

Fair enough. It has a good 'feel' to it. At 80% of NPAT the company looks to be largely rewarding shareholders, yet shrewdly tucking some money in the back pocket for a rainy day. But it's important to realise that this doesn't give us an accurate view of the dividend's long term sustainability.

Focus on the cash

Dividends are paid from cash, so to understand if a dividend can be sustained we need to compare the cash being paid out to the cash actually coming into the business. Companies that pay out more cash than they bring in don't stick around very long.

Comparing dividends to net profit after tax isn't very fair. Net profit after tax is really just an accounting concoction. It can involve subtracting large non-cash deductions like depreciation and amortisation from income and often doesn't represent the cash a company generates in a given period.

So how should we look at Woodside's dividend?

To get a true sense of the long-term sustainability of a dividend we are better to calculate a cash dividend payout ratio which compares the dividend to cash flow from operations adjusted for capital investment and preferred dividends. It looks like this:

Common Stock Dividends / (Cash Flow from Operations – Capital Expenditures – Preferred Dividend Paid)

From Woodside Petroleum's half year report we get this:

Cash Dividend Ratio = $413 / ($1,235 – $689 – $0) = 75%

It's only slightly below the net profit after tax ratio, but confirms that Woodside is paying out far less than cash it is bringing in. As far as dividend sustainability goes this is a great sign for the four years ahead.

From 2022 Woodside will start to increase capital expenditure for its next phase of major projects at which point reviewing the cash dividend payout ratio will be especially important.