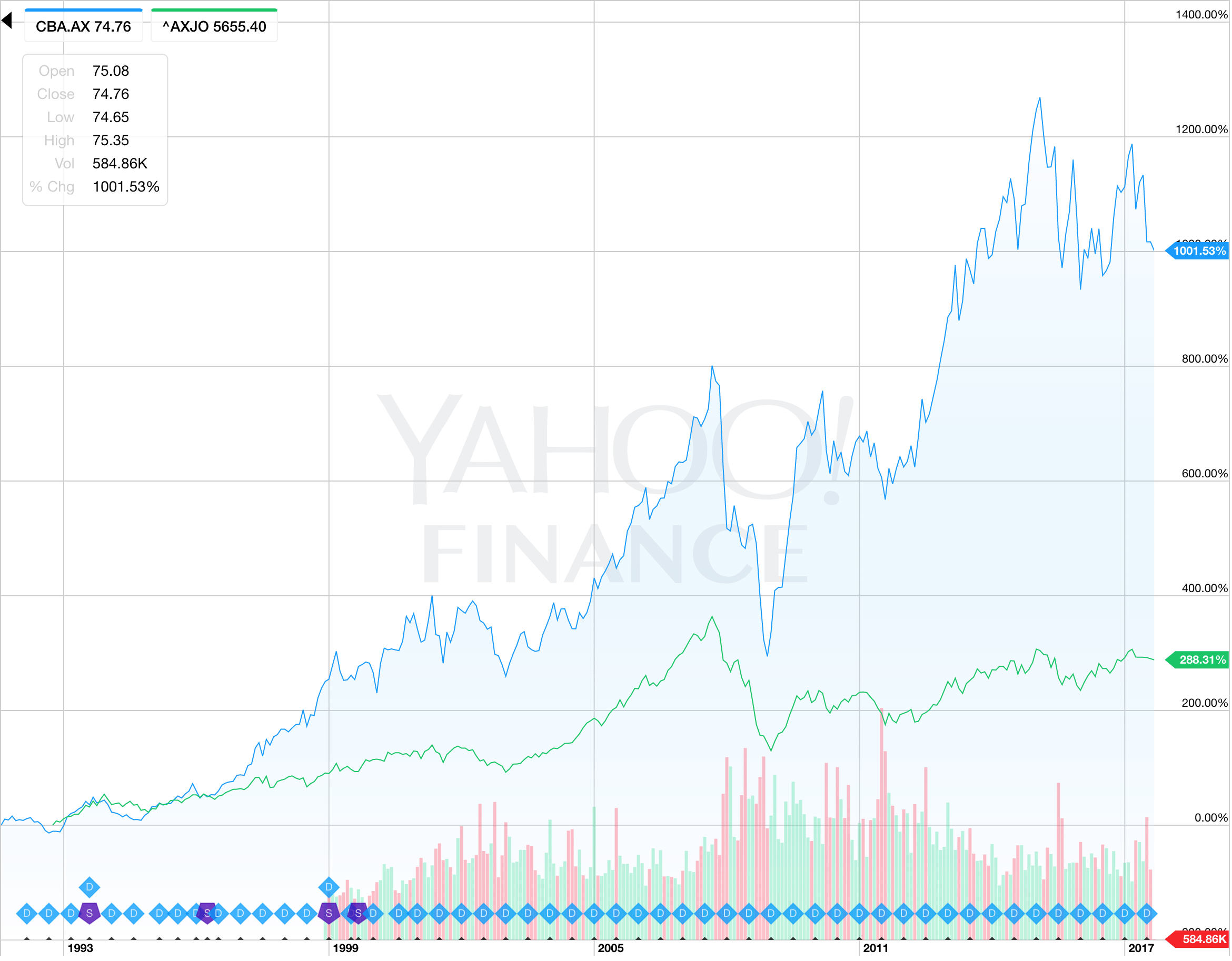

Let's just imagine that you sold your Commonwealth Bank of Australia (ASX: CBA) shares in 2000, having bought them for less than $6 during the IPO in the early 90's.

As the CBA share price approached $25 you would have thought you were some type of investing genius. Dividends and a 400% gain – that's great, right?

However, as you can see, if you held on from the early 90's until today your shares would be worth 10x more than your cost. Plus, you would have received — or reinvested — enormous dividends along away.

In fact, based on a cost price of $6, the dividends CBA shareholders received in 2017 are equivalent to a yield of around 72%!

And we thought the housing market was good.

1 financial decision you'll regret

According to behavioural psychology, we — the humans reading this — feel the pain of loss twice as much as the joy of gain. That's why investors do dumb things when share prices fall.

I think it also leads to one of the biggest financial regrets in retirement: selling.

Fortunately, there is one quick and easy fix: buy anything as though you will never sell it and control your emotions.

It's easier if you invest regularly. Periodically.

For example, let's say your plan is to invest $1,000 per month for the rest of your life. If you lose your entire investment, worst case it's $1,000 down the drain.

But, if your investment grows slowly over many years, I reckon you will completely forget about those dog investments. Why?

Because your downside is limited to 100% ($1000) while your upside is infinite.

So provided a few companies are growing slowly over many years your winning investments will quickly overwhelm your laggards by larger and larger multiples.

Foolish Takeaway

The key to this strategy is patience. Buying and holding great businesses/shares or Exchange Traded Funds (ETFs) works. Mind you, not every company will be a CBA — some will perform like Telstra Corporation Ltd (ASX: TLS). But over time the winners will greatly outweigh your losers and you will have no regrets!