This week I've been digging into business conglomerate Wesfarmers Ltd (ASX: WES).

It's a company I've avoided for a long time because it involves analysing multiple businesses across multiple industries. But on top of that, I never just never really 'got' it.

Sure, combining the earnings from Kmart and coal production into a single portfolio offers diversification, but beyond that there didn't seem much connection. And looking at the snapshot of businesses today, it does all seem a bit… motley.

It probably seems obvious, but the piece I was missing was the company history, which is pretty fascinating. If you think of Wesfarmers for what it was originally – a general trading cooperative born in sun glazed, rural Australia – the company today makes a lot more sense.

The co-operative was like a general supply store, dealing in things from fertiliser and spades to machinery and wheat. It's always been a bit motley, it just operates at a different scale today.

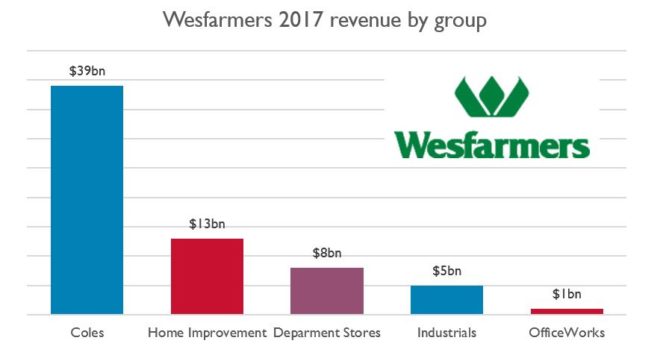

To better understand how this scale has shifted, more than 100 years later, here is a breakdown of the company's current business units by revenue for the 2017 financial year:

Coles (57%)

The Coles division brings in the bulk of Wesfarmers revenue and includes earnings from the supermarket, liquor and hotel operations.

As it goes with investing it's not what a company brings in that's important, but what it keeps. The Coles division is very much a low margin, high volume based operation and the group had an EBITDA margin (Earnings Before Interest Tax Depreciation and Amortization) of 5.8% in 2017.

Home Improvement (20%)

Those huge Bunnings Warehouses are the second biggest revenue contributor to the Wesfamers portfolio. They brought in $13 billion in 2017 and had a more robust EBITDA margin of 10.8%.

Department Stores (12%)

Kmart and Target made up 12% of revenue in 2017 with an 8.7% EBITDA margin. Target actually lost $10 million for the year, but Kmart performed positively with strong revenue and margin growth.

Industrials (8%)

Industrials are where the historic products like fertilisers, chemicals and energy show up. Although the division brought in less revenue than Department Stores, with a 21.2% EBITDA margin its contribution to earnings was much greater.

Officeworks (3%)

Officeworks needs no explaining and operated with a moderate 8.6% EBITDA margin in 2017.

Foolish takeaway

I think understanding the history of Wesfarmers goes a long way to understanding why the company operates such diverse spread of businesses today.

A wide portfolio makes it more complex to assess as a potential investor, but identifying the parts that contribute the most to the company's portfolio and hold the most risk, is an excellent place to start.