If you're investing on the ASX for growth, I think Pro Medicus Limited (ASX: PME), Paragon Care Ltd. (ASX: PGC) and Nanosonics Ltd. (ASX: NAN) shares should be on your watchlist.

Why?

Small-cap Healthcare Shares Outperform

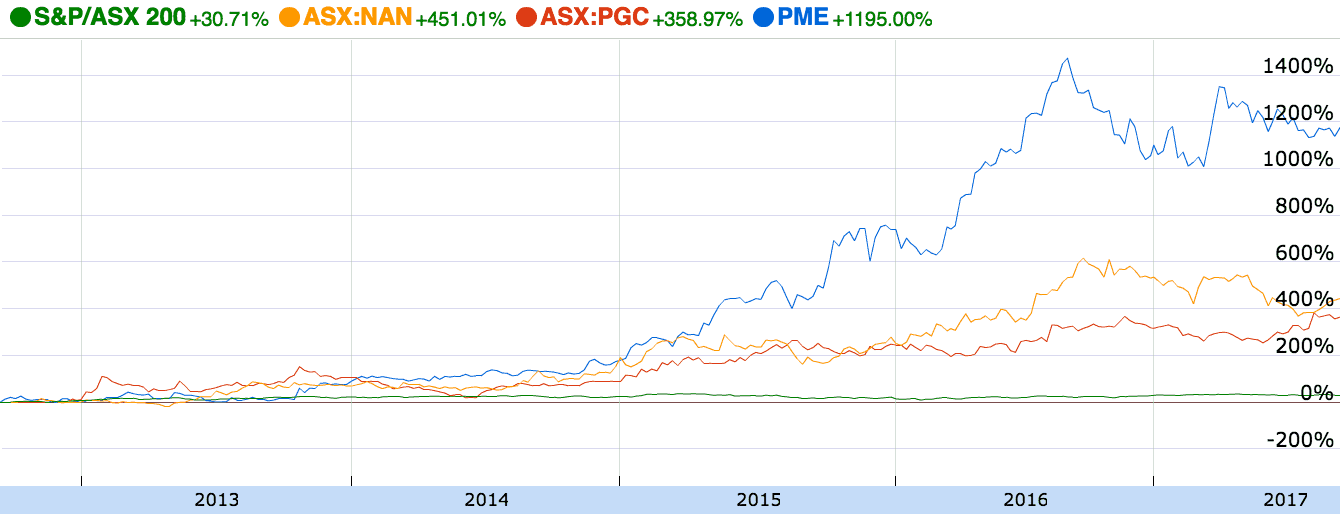

The chart above compares the shares of these three small-cap healthcare companies to the ASX's blue chip shares index, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO). While I have cherry-picked the companies, clearly, they have handily outperformed the market over five years.

Pro Medicus

Pro Medicus is one of my favourite small companies on the ASX. It has developed a lightweight software solution for doctors and radiologists to send and receive medical images, like X-Rays.

Its share price performance in recent years reflects its numerous contract wins with major hospitals.

It is obvious that Pro Medicus shares are more richly priced than they once were. However, if it continues to win new contracts with hospitals it could be worth a long-term investor's time and capital.

Paragon Care

Paragon Care is a not a 'sexy' healthcare technology company like Pro Medicus and Nanosonics — it supplies medical equipment to the domestic and Kiwi aged care and health markets. Paragon Care is also small, with the entire company worth around $150 million.

However, it offers a handy dividend and its valuation does not appear excessive to me.

Nanosonics

Nanosonics is not so much a 'small cap' anymore since it has grown rapidly to become an $800 million business. Nanosonics makes and markets its flagship product known as Trophon, an ultrasound probe and disinfector. Like Pro Medicus' device, Nanosonics' is a more effective and cheaper alternative to the legacy systems currently in use in many hospitals.

Foolish Takeaway

They may be smaller companies but I think Pro Medicus, Paragon Care and Nanosonics shares should be on every long-term ASX investor's watch list. However, they should be considered higher-risk than some other companies on the ASX.