When it comes to investing in Australian shares, the lazier the better.

Why lazy is financially sexy

Everyone knows being active is good for your health, right?

Do not be a couch potato, Oprah can wait.

Do not retire too early. Your brain will go crusty.

Do not put your finances on the back burner. They are too important.

Oh, you are 10 years old? Have you put in your preferences for university? Better late than never.

Don't just do something, stand there!

Indeed, in life, sometimes you need to be active. What you are doing now will determine where you end up.

Those abs won't sculpt themselves.

At other times, however, it is far better to be lazy.

One of those times is when you invest in shares.

That because 99% of long-term investing is doing nothing. Yet, it's the other 1% that change your financial life.

It is during these 1% moments that we decide to buy or sell shares. This is the time when we will make great or terrible decisions.

The other 99% of the time good investors look lazy.

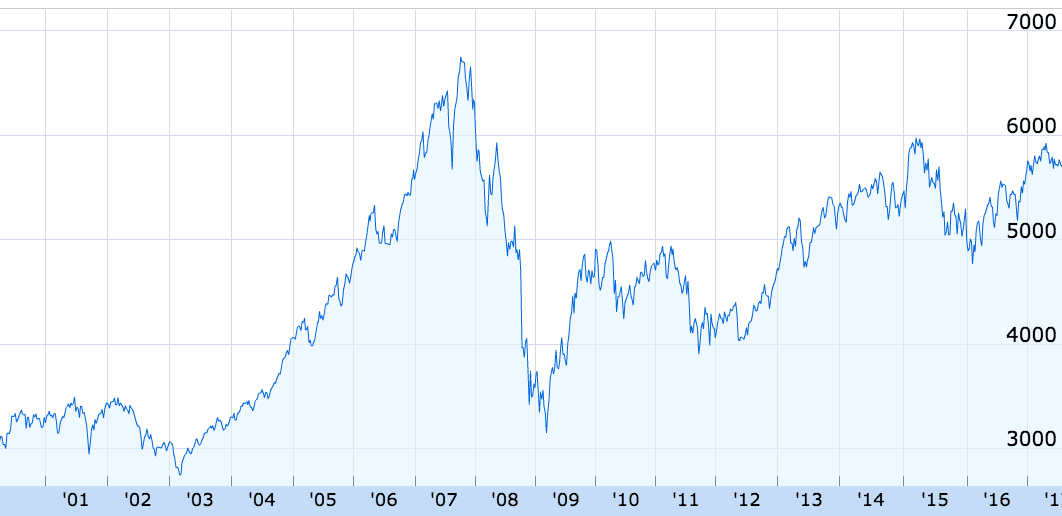

Day traders have it the other way around. Unfortunately, more often than not that's why they miss out on this:

The graph shows Australia's S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), which tracks the ASX's 200 biggest companies — not including dividends.

Sure, there are some peaks and troughs that day trading could have averted. But if you were 'lazier' than the day trader, chances are, you would be well ahead.

And if you keep reinvesting and adding regularly, you will have performed even better that that graph suggests because it does not include dividends.

According to Vanguard, Australian shares have returned, on average, 9.7% per year since 1970.

While the next 40 or so years may not be as good, I think it's safe to assume the sharemarket usually goes higher over the long run. Sure, people will point to Japan's sharemarket and the Nikkei 225, which hasn't gone higher in a long while (note: it does not include dividends).

But even the USA's Dow Jones, which is up over 10% per year on average over 40 years, has had decades when it did not go upwards — at all.

Yet, $10,000 invested in the US stockmarket back in 1970 would today be worth $1.6 million!

Get lazy and rich

Here is an example of the lazy way to stock market millions.

Even if we assume a 5% return from the sharemarket on average over 30 years.

- $10 per week reinvested becomes $34,548

- $100 per week reinvested becomes $345,482

- $200 per week reinvested becomes $690,964

And if we assume an 8% return:

- $10 per week reinvested becomes $58,907

- $100 per week reinvested becomes $589,073

- $200 per week reinvested becomes $1,178,145

I know what you are thinking: $200 each week! 30 years?!

I get it, not every lazy person can invest $200 per week in the sharemarket for that long. But, consider this:

- You may not be starting from $0

- If you are earning the national average wage (which is quite high, admittedly), your employer is paying almost $150 for your super each week, so you are almost there based on your super alone

- If you do not have 30 years to invest, you can still find ways to increase your investing rate beyond $200

- The sharemarket has returned more than 8% historically!

- AND it is possible to outperform the sharemarket average!

The lazy way to get rich is to invest small amounts, regularly, for the long term.

So forget about concentrating on what will happen in the sharemarket today or tomorrow. After all, too much concentration kills itself.

Swap your Six-Pack Ab Workout Machine for six cold ones.

Set up a Bpay directly into super or a brokerage account.

It's time to get your financial butt on that couch.