If you haven't heard of Paragon Care Ltd. (ASX: PGC) and Austock Group Limited (ASX: ACK), you'll want to keep a close eye on them after you read this.

Paragon Care and Austock Group

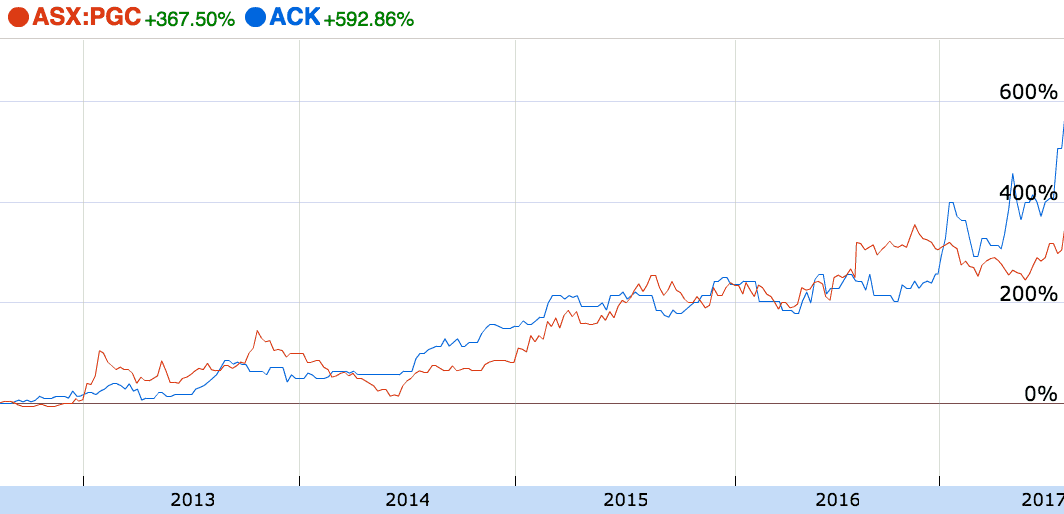

The chart above shows the share prices of these two small cap companies in action over five years. While Austock and Paragon shares are up 590% and 367%, respectively, the S&P/ASX SMALL ORDINARIES (Index: ^AXJO) (ASX: XJO) index is up just 10%.

Paragon Care

Paragon Care is a $160 million medical distribution business. Its business sees it provide medical supplies to both the health and aged care markets. Everything from scalpels and scissors to X-ray equipment and partitions.

Paragon Care has been able to grow its business by acquisition, with its number of shares growing rapidly, but also organically. Despite its growth to date, analysts believe its profits will rise over the next two years.

Austock

Austock is a life insurance company but its life insurance products are a little different. The $100 million company sells 'insurance bonds' or 'investment bonds'. Usually, these bonds are used by clients of good financial advisers or by people who are willing to put in some effort to minimise their tax.

Basically, you buy the investment bond, which itself can invest in other things like managed funds. It is taxed at less than 30%, so it is popular for high-income earners but also grandparents and parents investing for their children. After the first year, you can choose to add more money to your bond.

But here is the best part: after 10 years, you can retrieve the proceeds and your capital, tax-free. There is one important condition: you do not contribute more than 125% of the prior year's balance to the bond. For example, if there is $100 in the bond this year, you cannot add more than $125 next year. If you do, you will reset the 10-year countdown.

Ultimately, I estimate it is the second-best place for high-income earners to park their cash, behind super. I think Austock is well placed to benefit from the trend towards superannuation alternatives.

Foolish Takeaway

These companies may be tiny, but they have shown mighty potential. Of the two, Austock is certainly my favourite. Although it is a higher risk investment and should be viewed as a long-term buy to hold I think it could go on to impress investors, even from these prices.