Every pun intended, the Qantas Airways Limited (ASX: QAN) share price has flown sky-high in recent times, but it could crash back to earth.

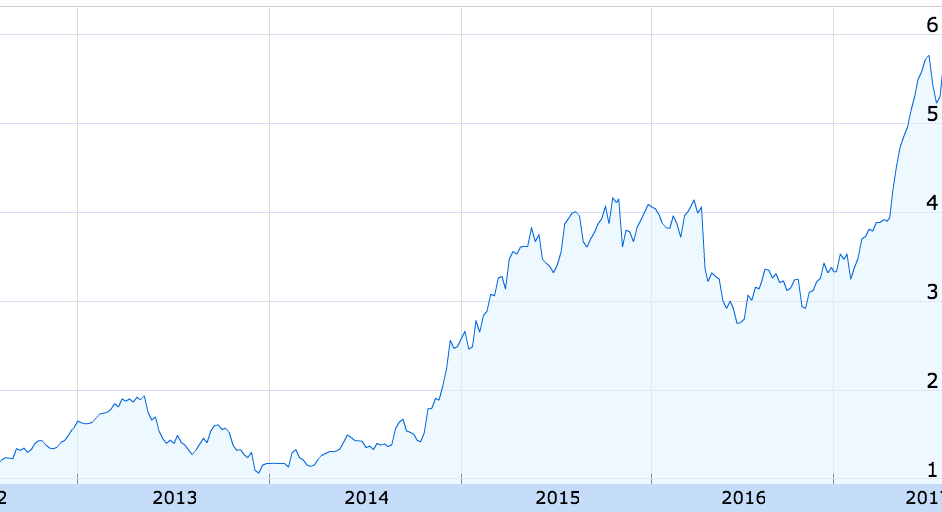

QAN shares price

Why I wouldn't buy Qantas shares

To understand why I — a long-term investor — wouldn't buy Qantas shares you need to humour me and play along…

Let's imagine you have $1 billion dollars (lucky you!) and must start a business (oh).

Now, the business you must buy is a transport business.

Unfortunately, you're not El Capitan driving a beautiful ship across tropical seas. You are the owner, who pays the captain and his staff a lofty wage.

But we're getting ahead of ourselves…

From your original $1 billion, you have a choice to either: spend a few hundred million on a vehicle, or rent for $50 million per year. Either way, you're responsible for maintenance, which is, say, $10 million.

You could take on five times your $1 billion in debt to buy more vehicles, but you're new so no-one is giving you a loan.

So you lease your vehicle.

You get it from a manufacturer who supplies the exact same vehicle to your closest competitors. The only difference is those competitors are owned by a government. Meaning, their budget is wayyy bigger than your budget, so they buy 10 vehicles at a discount.

And you're not buying a Tesla. So your transport vehicle runs on gasoline, which is your largest cost after the huge fixed costs and maintenance. Plus, the gasoline price bounces around quicker than a hockey puck in a game featuring the USA v. Russia, or the USA v. the Middle East, or Iran v. the world.

But just when you're about to get your business off the ground let's not forget you'll also need to pay first-world flight staff who are part of a union (oh no), and parking costs at your pickup and destination, which — again — you must pay.

Unfortunately, you cannot drop these passengers off at 30,000 feet.

"Finally!" you exclaim. "We're ready for our first passenger!"

Unfortunately, your first customer doesn't come easy.

You have to price your tickets higher than anyone else because, well, your fixed costs are higher relative to many of your peers.

Plus, the online sales people want their cut. Plus, carbon sucks for the environment, so there's that.

Ultimately, your profit margins are either non-existent or so thin, "they look like ants from up here!"

Welcome to the airline industry.

In summary, we have:

- Massive upfront costs

- Recurring variable costs (maintenance)

- Expensive pilots and staff

- The stiffest of competition

- Volatile fuel prices, and

- No pricing power

This isn't a beat up of Qantas. It's the same for any airline.

As Richard Branson, founder of Virgin, said: "The quickest way to become a millionaire is to start as a billionaire and launch an airline".

Of course, some investors will say there is a price for everything. Even shares of airline companies.

But with Qantas shares trading near their 10-year high in a cyclical industry, you must coldly ask yourself if the good times can continue.

Especially when you are not compelled to invest in anything. There are over 2,000 other shares on the ASX, you don't need to buy every one of them just because you can.

Your investment portfolio deserves the best.